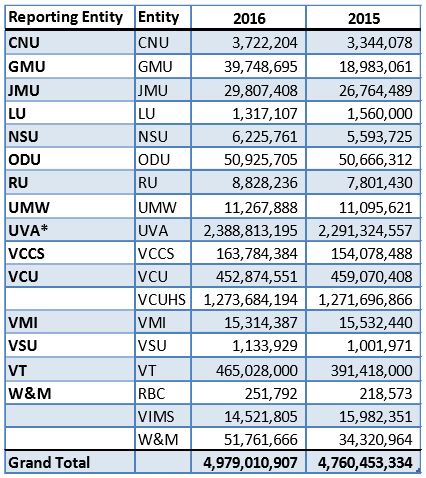

Unrestricted cash, cash equivalents and investments not with the Treasurer of Virginia. Image credit: Auditor of Public Accounts

When word leaked out about the University of Virginia’s $2.2 billion Strategic Investment Fund, UVa officials suggested that they had found a way to spin dross into gold. Sweeping up low-yield cash and short-term investments in assorted reserves and accounts, they consolidated a vast sum which, in the hands of the University of Virginia Investment Management Company, they expected to generate income of roughly $100 million a year. The financial innovation was a trick, they contended, that other public Virginia universities could do, too.

Yesterday, Eric M. Sandridge, audit director with the Auditor of Public Accounts, compiled a list of unrestricted cash and cash equivalents at Virginia’s major universities, which he presented to the House Appropriations Committee. That list is reproduced above.

Excluding UVa, Virginia’s higher ed institutions have $2.6 billion in unrestricted cash. Let us assume conservatively, as UVa does, that the cash, if placed in appropriate hands, could pay out 5% annually on a sustainable basis. That cash could throw off an ongoing revenue stream as large as UVa’s Strategic Investment Fund to use as the institutions see fit.

The primary beneficiary by far would be Virginia Commonwealth University, which accounts for $1.7 billion of the $2.5 billion, followed by Virginia Tech, which accounts for $465 million. (I presume that the “VCUHS” on the table above refers to VCU Health System.) A handful of other institutions could generate $1 million to $2 million in extra income a year. For the rest, the income would be chump change.

I’m not sure what the General Assembly intends to do with this information. I’m not even sure that other universities are set up to replicate what UVa has done — although VCU has a $2 billion endowment, second largest among Virginia public universities, and last year it created its own investment management company to manage the university’s financial assets. If VCU follows UVa’s strategy (and if I’m not overlooking something really important), in theory, the university could generate an additional $85 million in free-and-clear revenue each year. That would be a game-changer.

The VCU board of visitors then would face the same issue as UVa’s board: whether to use the windfall to advance the university as an institution or to make the university more accessible and affordable to students.