Results of the first 40 months paying unemployment benefits to military spouses leaving Virginia jobs due to family transfer. Source: VEC

Virginia’s unemployment insurance (UI) trust fund continues to show improved balances despite dropping tax rates, reflecting a strengthening economy. The most recent semi-annual report, released at a legislative meeting yesterday, projects half as many initial claims during 2018 as there were five years ago: 134,000 this year versus the earlier 276,000.

It the trend holds that would be a 45-year low, the Daily Press reported, quoting Virginia Employment Commissioner Ellen Marie Hess.

The trust fund balance probably peaked at $1.35 billion June 30, with slight declines expected in coming months. With the lower unemployment and higher workforce participation rates, the system is working as designed. More than 68 percent of the almost 215,000 Virginia employers paying into the fund pay at the lowest possible tax rate, which works out to $88 per employee.

The tax rates go up with a history of layoffs or other successful claims and are higher on new employers or employers based outside of Virginia. In general Virginia has some of the lowest taxes in the region, in part because it also has less generous payments.

The various charts track many other signs of economic improvement: More employers registered with the system, fewer of them paying elevated taxes due to past layoffs, lower general unemployment rates, and a labor force participation rate (66.2 percent) higher than the national average.

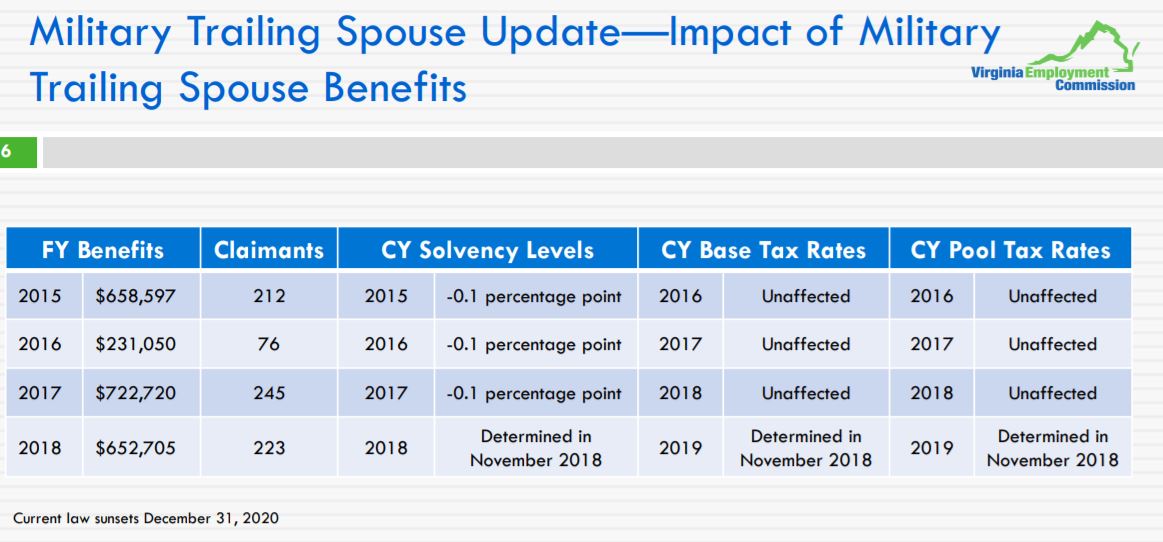

The report also tracks the impact of a controversial recent change in the system, allowing unemployment benefit payments to the spouses of military personnel who get reassigned outside Virginia. Prior to 2015 that was considered a voluntary termination, not a layoff, and thus not eligible for benefits.

Over the first 40 months 766 people have claimed benefits costing about $2.3 million.

Business groups, including the Virginia Chamber of Commerce, opposed giving this benefit to so-called “trailing spouses” because of fear it would be a major drain on the fund. The employer ultimately responsible for the move, the Department of Defense, pays zero into the state UI fund, but taxes are collected from whatever employer had the departing spouse on the payroll.

So far, the number of claimants has been so small there has been no measurable effect on the fund balance or tax rates. The military spouse benefit was passed with a sunset clause and has two more years to run before the General Assembly must end or extend it. It was advocated as another way to demonstrate Virginia’s commitment to the military, for economic as much as patriotic reasons.

Having the benefit may give Virginia some positive points should there ever be another round of base closures, but if there is and Virginia is on the losing end, the number of claims under this provision would spike.