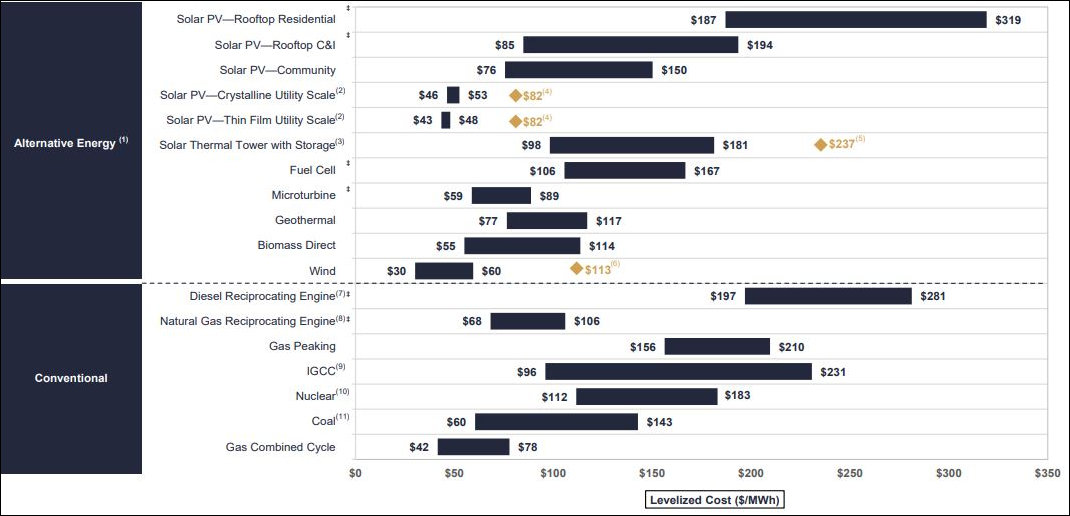

Source: “Lazard’s Levelized Cost of Energy Analysis.” Click graphic for more legible image.

As Virginia hurtles towards a renewable energy future with lots of solar and wind power, ratepayers and taxpayers should acquaint themselves with the complexities of Levelized Cost of Energy (LCOE) analysis. LCOE incorporates the costs associated with electricity generation — up-front capital costs, fuel costs, ongoing operations and maintenance costs — to compare the economic viability of conventional and renewable energy sources with very different characteristics.

In almost anybody’s analysis, the cost of utility-scale solar power in Virginia is highly favorable. The up-front capital costs are modest, fuel costs are zero, and ongoing operations and maintenance costs low. A heavy reliance on solar, an intermittent energy source that varies with the level of sunlight, does raise issues of system reliability. But as an energy source, it’s the cheapest around. However, the same cannot be said of smaller-scale solar projects or wind power.

The Lazard Levelized Cost of Energy Analysis is widely regarded as one of the most authoritative comparisons of LCOE. The chart above shows Lazard’s calculation of LCOE for the major categories of conventional and renewable energy. Utility-scale solar is the least expensive. Community solar and commercial & industrial rooftop solar are considerably more expensive but potentially competitive, and residential rooftop are not remotely competitive on cost. Nearly all of Virginia’s solar is utility-scale. Although environmentalist and activist groups are fighting for more community and residential solar, those categories are likely to remain marginal contributors to Virginia’s energy mix — options for those whose environmental consciences weigh heavier than their pocketbooks.

Wind power is a trickier issue. Lazard shows the LCOE ranging from $30 to $60 per megawatt/hour (or 3 to 6 cents per kilowatt/hour). Even the higher-cost wind is cheaper than all conventional sources excepting combined-cycle natural gas (large gas plants that burn gas with jet-like turbines and recycle the waste heat to run steam generators).

However, LCOE analysis depends upon various assumptions that may or may not pan out. Lazard’s “wind” numbers are based primarily upon the cost of generating wind on land, not establishing an offshore wind sector on the Atlantic Coast from scratch. The only thing we know for certain is that early adopters of offshore wind, who build before a supporting infrastructure is fully established, will pay more.

Another critical question is how many years wind turbines last before they must be retired. Coal, gas, and nuclear power sources are assumed to last 30 to 40 years, although some have lasted longer. The National Energy Energy Laboratory, accused by some of having a fossil fuel bias, says solar has a 25-year to 40-year economic life, but wind turbines only a 20-year life. I don’t know what life span Lazard assumes for wind, but I did find a LCOE analysis for wind power in Iceland that assumes a 25-year life.

Writing in the Center of the American Experiment, Isaac Orr notes, however, that 14 turbines in an industrial wind facility in Kewaunee County, Wisconsin, “has been decommissioned after just 20 years of service because the turbines are no longer cost effective to maintain and operate” — confirming the NREL assessment.

If the NREL numbers are accurate, the implications for Virginia’s energy future are significant. The Grid Modernization and Security Act of 2018 enshrined the goal of increased wind power as in the “public interest.” The State Corporation Commission has protested the cost of electricity generated from two proposed experimental wind turbines would be astonishingly high but approved the project anyway because the General Assembly, without conducting any of its own analysis, had declared it to be necessary.

The two experimental turbines are mere prelude to development of a much larger, 2-gigawatt offshore wind farm at cost of billions of dollars. Thanks to economies of scale in erecting offshore turbines, the levelized cost of the larger wind project will be a fraction of that of the experimental project. But if the 20-year life span of the Wisconsin turbines is any guide, wind turbines may not last as long as assumed, and may cost more. Moreover, we still don’t have any data on how well wind turbines will hold up in East Coast conditions — especially when buffeted by hurricane winds and waves.

Complicating the analysis, a kilowatt of electricity generated by a conventional fuel source upon command is worth more for maintaining grid reliability than a kilowatt generated by a renewable energy source delivered only when the sun is shining and the wind is blowing.

Not that it matters. In its wisdom, the General Assembly has mandated wind generation with no clear idea of what it will cost.