by James A. Bacon

In his budget roll out yesterday Governor Ralph Northam proposed hikes to tobacco and gasoline taxes and a clawback to taxpayer relief fund enacted last year in response to changes in the federal income tax code — an increase in the tax burden well in excess of a half billion dollars a year. (In none of the articles and documents I’ve seen have I been able to locate a full tally — gee, I wonder why.)

In his presentation to the Joint Money Committees of the General Assembly, the governor made a revealing comment.

“Here in Virginia, we pride ourselves on being a low-tax state,” he said. Then, in the context of the tobacco tax, he added, “But it makes no sense to cling to the bottom of the rankings that costs us so much.”

“Cling.” Interesting word choice. At least Northam didn’t refer to taxpayers as “bitter” clingers.

It is true that Virginia has lower-than-average gasoline taxes and the second lowest tax on tobacco products. But the Old Dominion also had the 10th highest income tax collections per capita and 17th highest property taxes, according to the Tax Foundation based on 2012 data. Add it all up, and Virginia’s total state/local tax revenue as a percentage of state income ranked 27th in the country. That’s not a “low” tax state in my book, it’s a “moderate” tax state.

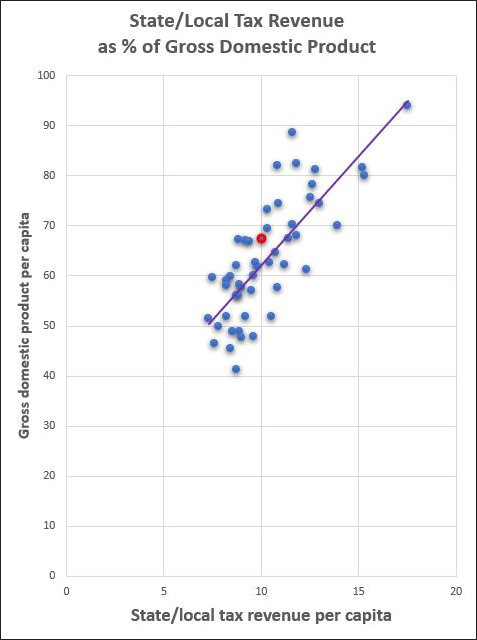

The chart above shows slightly different data based on FY 2020 data found on USGovernmentRevenue.com. There I plotted state/local tax revenue against gross domestic product (GDP). As one would expect, there is a strong correlation between GDP per capita and state/local tax revenue per capita — the purple line shows the trend line for the 50 states. (I excluded Washington, D.C., because it was such a strong outlier.) Virginia (the red dot) is in the middle of the pack, but slightly on the positive side of the trend line, meaning that its state/local tax revenues are modestly below what would be expected given its GDP per capita.

Northam’s tax increases and clawbacks will move Virginia significantly toward the trend line and closer to the national average for state/local tax burden. By no stretch of the imagination, assuming the General Assembly adopts the governor’s tax proposals, will Virginians be able to “pride” themselves on being a “low tax” state any longer.