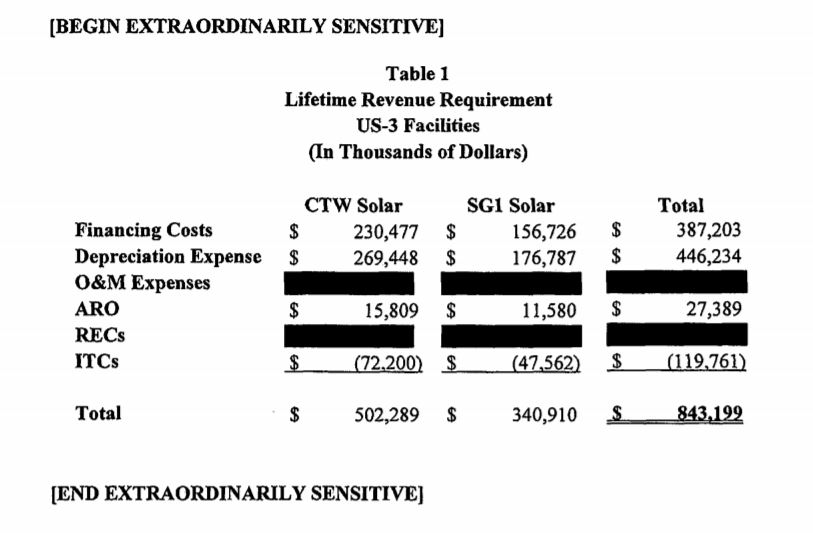

All-in lifetime revenue requirement for two solar projects related to Facebook. Key data is hidden. Operating and maintenance costs are also kept secret, perhaps to prevent simple math from disclosing the RECs. ARO stands for “asset retirement obligations” and ITC is the federal tax credits. Source: SCC staff testimony.

“Facts are facts, and the SCC does a really good job of compiling them.” Former State Senator John Watkins of Chesterfield.

After demonstrating that two solar energy facilities Dominion Energy Virginia has proposed in a deal with Facebook leave ratepayers holding all risks, reported already in the Richmond Times-Dispatch, the State Corporation Commission staff suggested an interesting solution that shifts that burden.

“Should the Commission determine that the proposed US-3 Solar Projects are not prudent as filed, the Commission may want to condition approval on the implementation of cost recovery through a rate adjustment clause (“RAC”) based on the market index in lieu of the cost of service model proposed in this case,” wrote Gregory L. Abbott, deputy director of the utility division. His and other documents are available online.

“This would reasonably protect the nonparticipating customers from performance risk as the customers would only pay for the actual MWhs that the proposed US-3 Solar Projects produce. Implementing cost recovery through a RAC based on the beginning market index price of $31.82/MWh would also meet the Commission requirement in Case No. PUR-2017-00137 that Schedule RF should be implemented in a manner that holds nonparticipating customers harmless,” Abbott concluded.

So. Instead of guaranteeing the utility a full return of its capital costs with profit, the SCC might instead charge ratepayers no more than the market value of the power produced. On this deal, Dominion would be no better protected than an independent merchant power producer.

This little case, involving only 240 megawatts of production and $410 million of construction cost, is important because after Facebook come others with similar or larger appetites. This is the first of many such arrangements the company expects under its experimental special rate for customers demanding the appearance of green energy virtue. Any new plants need SCC certificates of public necessity and convenience.

The Commission last year approved the experimental “RF” tariff designed to serve the new Facebook facility and others like it, but included this in the order: “As acknowledged by the Company, however, our approval herein does not represent a presumption or pre-approval of any subsequent proposals related to Schedule RF….We agree with Consumer Counsel that Schedule RF should be implemented in a manner that holds non-participating customers harmless.”

Here is how it appears to work: Facebook will buy the same “tainted” power including from fossil fuels and nuclear from the grid as everybody else, but to keep its green cred intact also promises to buy 100 percent of the renewable energy credits and other “environmental attributes” for a comparable amount of power from solar. Those contracted payments are applied to the capital pay-off for 20 years and lower the cost of the project for other ratepayers, who will still see a rate adjustment clause (US-3) on their bills.

Dominion is not building solar to connect directly to Facebook, and should a third party try to do that in Dominion’s monopoly territory, heads would roll. That monopoly is the most valuable asset its stockholders enjoy. The only difference between this and any other solar project appears to be the sale of the RECs to Facebook instead of into some other market. I’m open to correction on that point.

One point the SCC staff makes is it didn’t have to be a company-built project. Staff witness Earnest J. White said Dominion could have met Facebook’s needs by purchasing an existing solar facility. “This option would have permitted the Company to know, rather than estimate, the benefits to customers before exposure to risk of performance,” he wrote. (Unmentioned by him – that option does not produce 9.2 percent annual return on equity for the utility. )

The revenues from the renewable energy credits at the two plants, along with the tax credits, are applied to the 35-year payoff on the two new solar facilities, reducing costs to ratepayers. But as the SCC testimony makes clear, two variables then become crucial. The first is the capacity factor of the project (what percentage of the time power is produced) and the second is the market value of those renewable energy credits. The two are interrelated because the RECS are based on actual output, not 100 percent capacity – less output, less REC revenue.

Complicating reporting on this case, as usual, are all the key data covered up with black ink or entire memos withheld from public scrutiny. The projected REC revenue is kept confidential.

With solar sometimes the sun doesn’t shine, just like with wind sometimes the wind doesn’t blow. Sometimes plants are just down. Dominion’s application for these two solar fields in Surry County use accounting based on a 28 percent capacity factor, but the SCC staff argues existing solar in Dominion’s portfolio produces at 20 percent.

A 28 percent capacity factor means the equivalent of 6.7 hours per day of full power production, every day, versus 4.8 hours per day every day at 20 percent. That extra 40 percent makes all the economic difference. This exact same argument over what is reasonable to expect and base plans upon is underway in the integrated resource plan case.

Abbott’s testimony puts some dollars on the dispute.

“With a Company-build option, customers are responsible for the full cost of a facility over its life even if it does not achieve a 28% capacity factor. Staff calculates that in just the first year of operation, a capacity factor of 20% would result in over $1 million of cost recovery shifting from Facebook through lower-than-projected REC sales to the nonparticipating ratepayers.

“In addition, Staff calculates that in just the first year of operation, the lost energy production associated with a 20% capacity factor would cost the nonparticipating ratepayers over $6.5 million. In effect, the nonparticipating ratepayers would pay for lost energy production twice, first through the proposed Rider US-3 (for energy that was not delivered) and secondly through the fuel factor (to replace the energy that was not delivered).”

Facebook would still be one of those customers, but would only be on the hook for the minuscule share any other major customer would pay. It would still have all the “environmental attributes” it contracted for. But it does not have the risks it would face if it owned the plants, or directly contracted with Dominion to pay for the plants.

The story is all about risk, who is holding the bag if the projections are wrong or after some unexpected cock-up. As with virtually everything else the utility has persuaded a pliable General Assembly to accept at face value, the risk is entirely with its customers, not its shareholders. They get a profit margin based on risk without actually taking any.

John Watkins trusts the SCC on the facts. You should too.