The key to Dominion Energy’s successful efforts in the 2018 General Assembly was an alliance with the major environmental advocacy groups who saw several of their key goals achieved by the massive bill: promises of more wind and solar generation and massive spending of ratepayer funds on energy efficiency programs, coupled with weaker cost-benefit requirements for those programs.

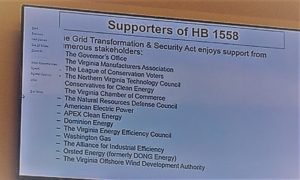

It was the environmental groups that brought substantial Democratic votes and the support of the Governor’s Office to the Dominion team. The environmental advocates dominated the list of supporters highlighted in the final committee meetings (see above.) As has been noted on Bacon’s Rebellion before, the major environmental groups give far more financial support to some Virginia politicians than do the utilities.

But the partnership didn’t hold as Dominion sought State Corporation Commission approval of a 100 percent renewable energy tariff, rejected by the SCC earlier this week. Customers who want 100 percent renewable power (or want to claim that is what they are using, given who knows where each electron flows from) are currently free to seek a competitive supplier. Many do. The only way Dominion can drive the competition out of its territory is to create its own approved green tariff.

Years ago the General Assembly authorized an exception to the utility monopoly for any customer seeking 100 percent renewable power, unless or until the utilities came up with their own way to provide it. It has proven to be a challenge.

The SCC rejected Dominion’s latest proposal after a hearing examiner found it really wasn’t a tariff but merely a formula for calculating a price based on several variables that would fluctuate. It was not a fixed price, nor was it a predictable price, so how could the SCC rule it was a fair price? (The term of art is just and reasonable.) Should the SCC approve a formula that produced an unreasonable price, nobody would actually seek 100 percent renewable service – clearly not the General Assembly’s goal.

The other major problem: Lacking its own green power, much of the renewable power would be bought from third-party providers or through PJM, and Dominion sought to layer on its own profit margin – the same margin in fact as is allowed for investments of its own capital.

The flaws in the proposal were gleefully highlighted by many of the same environmental activists and competitive energy companies who showed up on the supporter list for House Bill 1558.

“At its core this case is about retaining competition to provide a specific type of renewable energy in Virginia,” wrote attorney Will Cleveland of the Southern Environmental Law Center, on behalf of a coalition of environmental advocacy groups. “If the Commission approves tariffs in this case, the competition for 100 percent renewable energy disappears, and participating customers with over one megawatt peak demand can no longer shop.”

Elsewhere in the same document: “(T)he CRG Rate Schedules do not contain a rate, but instead they contain a formula for a rate with many key unknowns. The Company plans to base the inputs for several of these unknowns on internally-developed forecasts, which will not be subject to Commission oversight or review. As a result, the ultimate rate produced by the CRG Rate Schedules may be higher than market prices depending upon the accuracy of the Company’s forecasts.”

Opposition also came from the existing third-party providers who are now able to compete with – and beat – Dominion. These of course also make a profit on their business, but surely material gain could not be their motive! In its final comments Direct Energy focused on the hearing examiner’s finding that the proposed profit margin was “inconsistent with traditional ratemaking principles because a utility makes no up-front investment in a (power purchase agreement) justifying a return to compensate investors for the cost of their capital.”

The SCC agreed with them and they stay in business in Dominion’s territory. Dominion is free to compete with them, and has already done special contracts with companies like Amazon and Microsoft for Virginia-based facilities – but the operative word is “compete.”

Virginia’s other major investor-owned utility is advancing its own proposal at the SCC, and the case is in its earlier stages. I’m still feeling my way in this minefield, but its proposed Rider WWS (Wind, Water and Sunlight) seems very different than Dominion’s, and seems to produce a more predictable price based on the market value of renewable energy credits (RECs) from its own assets. Wal-Mart Stores and one other entity have already provided opposing comments, but the environmental groups have not weighed in yet. Getting that camel’s nose of competition back out of the tent? Not so easy.