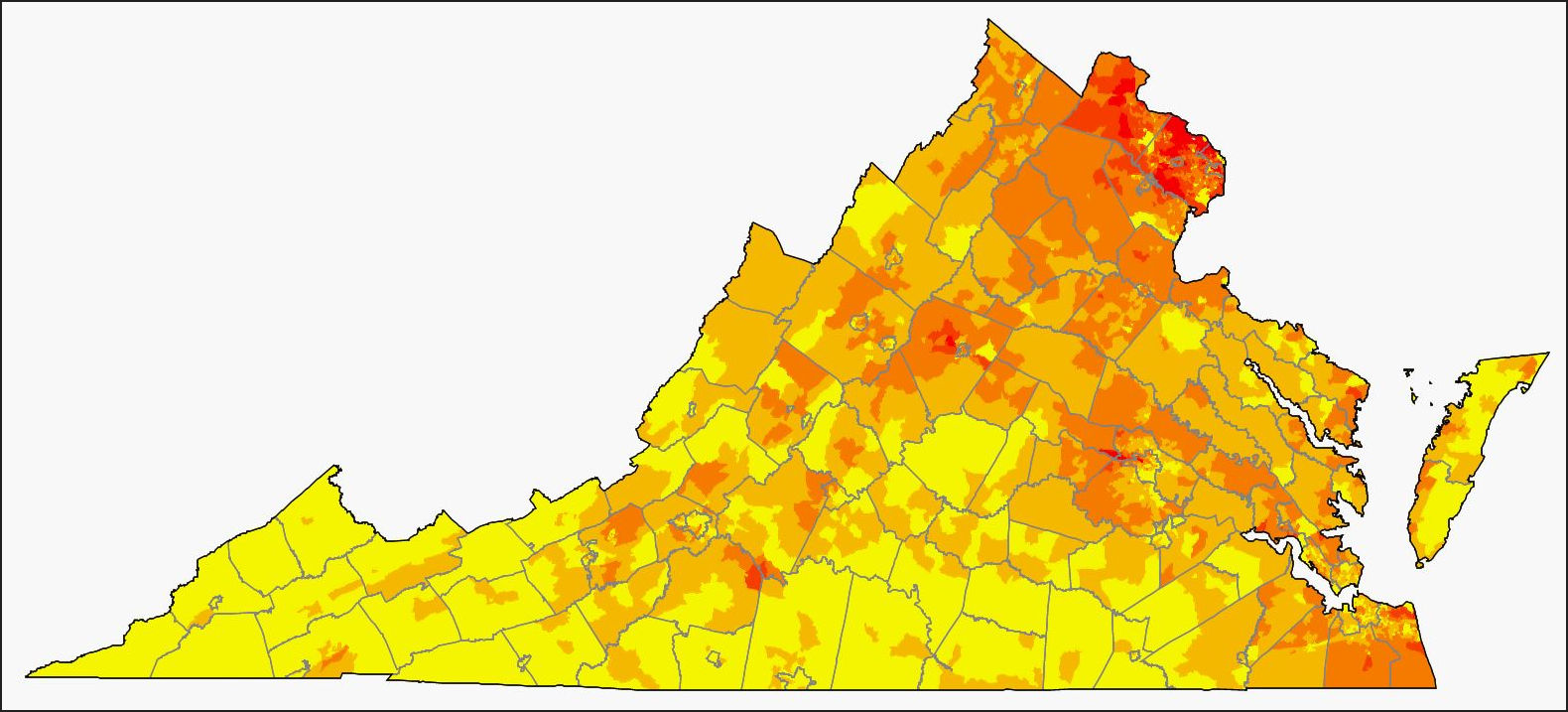

Virginia median owner-occupied house values by census district. Source: StatChat blog. Click to enlarge.

The StatChat blog has published a fascinating map showing the median value of owner-occupied housing across Virginia by census tract. The map appears as part of an essay on the relationship between housing affordability and school quality, which I may blog about later. But in the meantime, I thought the map was worth publishing on its own terms.

There are no huge surprises here — the highest median values occur in Virginia’s major metropolitan areas, most notably Northern Virginia, and values are lowest in depressed rural areas, particularly Southside and Southwest Virginia. (The blog post does not contain a color key indicating what values the colors represent, but you still get an idea of relative values.)

Still, there are some small surprises. There are patches of high values in Albemarle County just west of Charlottesville and to the south in (what I assume to be) Smith Mountain Lake. Values are relatively elevated in the Interstate 81 corridor from Roanoke to Winchester.

Picking up on themes previously explored on Bacon’s Rebellion, the rural/metropolitan schism in property values illustrates how difficult it is for homeowners in yellow areas (the lowest median values) to pick up and move to red areas (highest-value) in response to better job opportunities. The map also demonstrates the gulf in the tax base of local governments, which depend upon property taxes more than any other revenue source.

— JAB