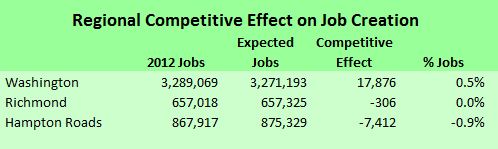

How competitive are Virginia’s three major metropolitan regions when it comes to job creation? EMSI, an economic modeling firm, has come up with an intriguing methodology to tease out the “regional competitiveness effect” of the nation’s 100 largest MSAs, and the results do not comport with Virginia’s image of itself as one of the best states (once upon a time the best state) to do business.

The methodology is simple but ingenious. The consulting firm calculated the number of “expected jobs” for each region in 2012 by factoring in the national rate of employment growth and adjusting for the regional industry mix. Then the firm compared the number of “expected” jobs to the number of actual jobs. The difference, it suggests in an article appearing in New Geography, can be attributed to unspecified regional attributes.

The Washington metro region is Virginia’s job-creation champion, blessed by a strong industry mix. But what happens if leading industries suffer reversals when the federal government hits the brakes on spending? The Washington region does possess a modestly favorable competitive advantage attributable to regional factors — but only a modest one. Washington gained only 0.5% more jobs than expected. That compares to national leaders San Jose (3.5%) and Austin (3.4%).

Richmond under-performed expectations by a tiny number, scoring effectively zero, putting it in the same league as Miami/Fort Lauderdale and Albany/Schenectady. In effect, Richmond’s growth and prosperity is at the mercy of national and industry trends.

Hampton Roads under-performed by a disturbing margin, 0.9%, which makes it a peer of regions like Memphis and Jacksonville. Without significantly improving its regional competitive advantages, Hampton Roads could suffer a long, slow downward slide. Citizens can take some consolation, however, in the fact that Albuquerque (-3.4%) and Augusta (-3/9%) are far worse off.

Questions, questions, questions. EMSI does not tell us what characteristics affect regional competitiveness. One would suspect that labor-market characteristics such as education level and skill mix are critical. Perhaps the quality of infrastructure and the presence of R&D universities weigh in the mix. Other attributes might be taxes, right-to-work, functional human settlement patterns, and “coolness.” We simply don’t know. One can hope that EMSI will dig deeper to give us a better idea.

EMSI also doesn’t tell us how enduring this “regional competitive effect” is. If it reflects slow-t0-change underlying attributes like those described above, one would expect the effect on jobs to persist year after year. Does it? I would like to see how regions performed in previous years. If the results bounce around all over the place, there may be less to this methodology that meets the eye.

Wake-up call. Despite the unanswered questions, this survey should give Virginians pause. We’re not doing badly, but there is nothing here to suggest that we are national leaders in economic performance. We’re coasting more or less in line with the national average. When the United States is losing competitiveness on the global stage and faces fierce macro-economic headwinds associated with chronic budget deficits and monstrous national debt, being average just isn’t good enough.