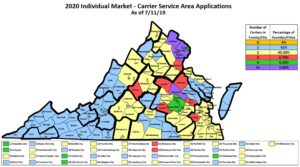

Number of carriers selling individual health insurance policies for next year by locality. Most places have only one or two. Source: SCC. Click for larger view.

The number of Virginians buying health insurance as individuals is shrinking and may shrink more, with two trends getting most of the credit: Expansion of Medicaid eligibility and a change in the law that allowed those in business as sole proprietors to buy policies in the small group marketplace.

Individual coverage peaked at 418,000 Virginians in 2016 and dropped to 300,000 by March of this year. The projection for 2020 is about 303,000 covered that way, the State Corporation Commission was told in a presentation on the health insurance market released July 18. You can see the full presentation here.

Compared to coverage through an employer’s plan or some other pool, the individual plan premiums, deductibles and co-pays can be crushing. The SCC is in the process now of reviewing proposed rate adjustments for 2020, which then go on for further review by federal authorities before final approval. Many individual plans will be charging less for 2020, about four percent less on average, Insurance Commissioner Scott White told the judges.

The SCC’s authority extends to small group and individual plans, which represent about 8 percent of the total insurance market, still dominated by employer-sponsored plans (49 percent) either purchased under large group plans (1.15 million people in 2018) or self-financed by the company (3 million people in 2018). Medicare, Medicaid and other federal plans including military-related coverage accounted for 33 percent.

Some of the other key points brought out by the staff’s presentations, which included information from the Insurance Bureau’s chief actuary David Shae, follow.

An estimated ten percent of Virginians had no insurance in 2018. That was 12 percent a decade earlier, and the recent peak was 13 percent 2010-2012. Proponents of the Affordable Care Act “would probably have thought it would go down more,” White said, and with full implementation of Virginia’s new Medicaid cutoffs in 2019 that “should go down somewhat dramatically.”

The drop in the individual plan premiums expected for 2020 is because the 2018 premium increases were excessive. When making calculations for 2018, the projections were based on the market’s experience in 2016 and 2017, and thanks to the turmoil over the ACA in Congress and its near-repeal, uncertainty ruled. After the repeal effort failed, insurers have seen more stability.

Despite the dip in individual premiums, the $651 average weighted monthly premium still reflects a compounded 12 percent annual increase since 2014, Shea said. The small group plans have averaged 5 percent increases annually during that period.

Behind the dip in individual rates for 2020, underlying costs and utilization are still growing steadily. Another expected expense that all the plans are passing along is the return of the ACA health insurance tax (HIT), suspended for 2018 but at this point the moratorium is expected to end.

A sign that premiums after the ACA turmoil were excessive is the loss ratios some plans have since reported, spending less than the required 80 percent of their premium revenue on medical benefits in 2018. Where that happened, policy holders can expect refunds to be ordered by the federal authorities, White said.

Another sign that stability is returning is slight growth of the number of carriers offering coverage around the state, although not every carrier offers plans in every locality. More than 85 percent of Virginia’s localities have only one or two providers of individual coverage, with the most competition showing up in the corridor from Richmond to Washington, DC.

In comparison, everywhere in Virginia at least ten companies offer small group coverage, with some localities seeing fifteen firms compete for that market.

White told the judges that a study requested by staff projects the individual market will shrink to about 220,000 by 2023 with about 70,000 leaving for Medicaid, 25,000 sole-proprietors leaving for the small group market, and 10,000 taking the new option of a Short-Term, Limited Duration Insurance (STLDI) plan intended for those in a transition period. More about those here. Fewer than 200,000 will remain in the individual market taking the ACA subsidy to help pay their premiums, down from more than 260,000 doing so this year.

That will leave about 20,000 still seeking individual coverage who do not qualify for any ACA subsidy. “It looks like that is where the damage has been done,” Judge Mark Christie commented from the bench at one point, referring to the impact of the federal ACA. He worried about people outside of employer plans making too much for Medicaid or a federal ACA subsidy.