By Peter Galuszka

Imagine it is Alabama in early 1965. The Southern state, like Virginia, has for decades deployed a number of ruses such as poll taxes and literacy tests to prevent U.S. citizens and state residents from voting. These people otherwise would have been qualified voters but also happened to be African-Americans whom the ruling white elite wants to keep from exercising their constitutional right. In Selma in 1965, three civil rights workers, Jimmie Lee Jackson, James Reeb and Viola Luizzo who are advocating for voter rights, are shot and killed in their car by the Ku Klux Klan.

decades deployed a number of ruses such as poll taxes and literacy tests to prevent U.S. citizens and state residents from voting. These people otherwise would have been qualified voters but also happened to be African-Americans whom the ruling white elite wants to keep from exercising their constitutional right. In Selma in 1965, three civil rights workers, Jimmie Lee Jackson, James Reeb and Viola Luizzo who are advocating for voter rights, are shot and killed in their car by the Ku Klux Klan.

Travel a bit farther into south Texas and find that the Lone Star State has its share of disenfranchisement devices in use to stop Mexican-Americans from voting, even though some have been legal residents from the day Texas became a state and part of the United States. In some counties, Mexican-Americans are by far the large group, which is exactly why the white elite want them not voting in strength.

And imagine, a well-meaning, white, privileged and otherwise intelligent man from these parts supporting restrictions on voting, telling people they should “get over it.”

Welcome to the future. The events in 1965 resulted in the Voters Rights Act, a landmark piece of legislation. Yet when Gov. Robert F. McDonnell signing his own weasely version of the voter identification law supported by arch conservative Republicans in the General Assembly, the Old Dominion, most of which still under federal election supervision for its tarnished past, is putting new roadblocks in front of voters.

They used to have to show a photo ID and if they didn’t have one, they’d sign an affidavit saying they were who they claimed to be. Now, their vote will be “provisional” and they will have to show up official at a later date and show the ID. Only then will their vote be counted. To make things easier, McDonnell is ordering millions of new “voter ID” cards to be issued statewide. Odd that he doesn’t mention how much this will cost since the flavor of the moment is strictly containing budget expenses.

A few points on this rather strange set of events:

- There have been absolutely no known major scandals involving voter fraud in Virginia. So, if there’s nothing broken, why go through all the trouble to “fix” it?

- It is clear that restricting voting is a major ambition of the Republican Party which fears that President Barack Obama may get the boost in November’s election as he did in 2008 from the poor, the minorities and the young.

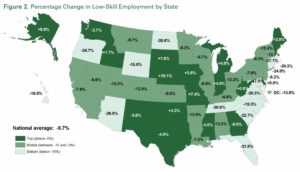

- Regarding these groups, 25 percent of African-American voters do not have valid government-issued IDs compared with 8 percent of whites, according to a study by the Brennan Center for Justice at New York University. Some 15 percent of people earning less than $35,000 a year likewise have no such ID. According to the Project Vote, about 15,000 people voted without IDs in Virginia in 2008.

Thus, Virginia’s conservative leaders and their cheerleaders are targeting what they consider to be a threatening group of voters as part of a campaign to correct a phony “wrong.” This is just another part of a sweeping socially-conservative agenda that has women, gays, dark-skinned immigrants and African-Americans in their crosshairs.

And no, I’m not going to “get over it.” I refuse to be patronizing when it comes to basic civil rights.

Estimado Jefe!

Estimado Jefe! By Peter Galuszka

By Peter Galuszka

By Peter Galuszka

By Peter Galuszka