from Liberty Unyielding

from Liberty Unyielding

For generations, Washington State had no state income tax, because of anti-income tax provisions in its state constitution. But the Washington state supreme court recently upheld a classic example of an income tax — a state tax on income from capital gains — by making the absurd argument that a capital gains tax is an “excise tax,” not an income tax. That was nonsense. The IRS and all other states deem capital-gains taxes to be income taxes, because they are levied on the amount of income you make from selling an asset, such as shares of stock or the sale of your home. The state supreme court could not deny this, and seems to have been motivated by racial, rather than legal, considerations, in reaching its ruling. It claimed that Washington’s traditional tax system “perpetuates systemic racism by placing a disproportionate tax burden on BIPOC residents,” who pay a higher fraction of sales taxes than of income or capital gains taxes.

As broadcaster Jason Rantz notes, the state supreme court’s opinion “doesn’t read like a Court decision, but a press release from a pro-tax, anti-capitalist Seattle activist group. But that’s what the Washington State Supreme Court has become.” The state supreme court’s 7-to-2 ruling is in tension with the fact that, as the tax consulting firm RSM notes, “the IRS defines capital gains as income and the Washington capital gains tax relies on federal income tax reporting.”

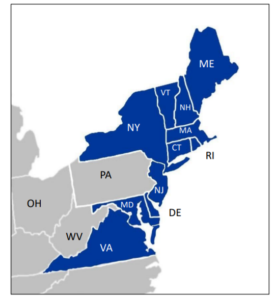

If other state supreme courts similarly redefine income taxes as excise taxes, that could weaken tax limits contained in other states’ laws, such as Virginia law’s ban on income taxes levied by cities and counties. This Tuesday, Virginia is holding legislative elections. Virginia’s legislature picks the state’s judges, and Democrats are slightly favored to take control of the state legislature. When they last controlled the Virginia legislature, the Democrats expanded and packed the Virginia Court of Appeals. But the Virginia supreme court currently is split 4-to-3 in favor of Republicans. Residents of northern Virginia pay 3.2% less of their income in taxes than residents of neighboring counties in Maryland, because Maryland permits county income taxes, and Virginia doesn’t.

If Democrats win the Virginia elections Tuesday, they could pick judges who uphold taxes at odds with the state constitution. Continue reading

from The Republican Standard

from The Republican Standard

from Liberty Unyielding

from Liberty Unyielding

by Dick Hall-Sizemore

by Dick Hall-Sizemore by Derrick A. Max

by Derrick A. Max

by Chris Braunlich

by Chris Braunlich