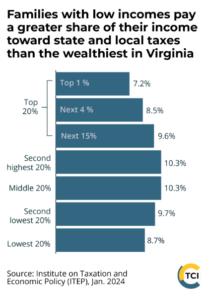

Econ 101 Quiz. Virginia Democrats are poised to raise the sales tax 1% in most localities, add digital products to the taxed services, and create a new payroll tax. How will those changes impact that chart? Click for larger view.

By Steve Haner

A piece of Republican Governor Glenn Youngkin’s tax package has survived after all, but only the part that increases the sales tax base to collect about $1 billion or so more per year from citizens. Democrats who recently complained that sales tax increases were unfair to the poor are suddenly embracing them.

On Sunday, both the Virginia Senate and the House of Delegates budget committees approved Youngkin’s budget language to impose the sales tax on a host of digital products and services, adding 6% or more to the prices of downloads, streaming services, and online data storage. The full range of newly taxed transactions is not yet clear.

The Senate then increased the gain to the treasury by making sure the new taxes will also cover business-to-business transactions, something the governor sought to exempt and something which is just passed along in higher prices.

The risk of including that tax policy initiative inside Youngkin’s introduced budget bill was obvious from the start, and General Assembly Democrats have now pounced on the opportunity to capture that revenue. The tax increase is now wrapped in with all the state spending for two years, a hard bill to vote against. Continue reading

by Jon Baliles

by Jon Baliles

by Derrick Max

by Derrick Max