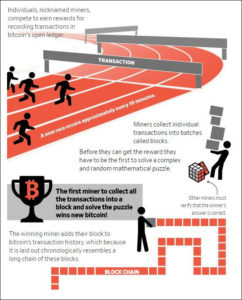

If you don’t understand how to mine bitcoin, try reading this Wall Street Journal graphic. You still won’t understand, but at least you’ll have tried. (Click for larger image.)

If people want to invest in bitcoin, or invent competing cryptocurrencies, or dedicate their computers to “mining” bitcoin by solving computationally difficult puzzles, well, it’s a free country and they can do what they want. As a political-policy commentator, I would never advocate banning such endeavors. As a social commentator, I am moved to ask, are these people out of their minds? What a socially useless activity.

As a economic-development commentator, however, I must cheer the initiative of Frederick Grede, Michael Adolphe, and other principals of Bcause, a company that aspires to become the largest bitcoin mining operation in North America. The Virginia Beach-based company has raised $5 million in funding led by Japanese financial-services firm SBI Holdings and plans to raise more.

A Wall Street Journal article today describes how Michael Poteat, an engineering student at Old Dominion University, started mining bitcoin four months ago. He purchased 20 “mining rigs,” computers that solve complex equations to generate new coins. The 20-year-old kept tripping the circuit breaker in his house, and he struggled to find a place to accommodate his operations. “It’s just difficult as an individual to handle all the logistics,” he says.

Then Poteat came across Bcause, which provides the infrastructure, security, and electricity to enable large-scale bitcoin mining. The WSJ elaborates:

Bitcoin miners are rewarded with new coins and transaction fees for performing the calculations that make the bitcoin network tick. The more valuable a bitcoin is, the greater the incentive to start mining. But the more miners who participate, the more computations are needed to earn rewards.

The process can be expensive and cumbersome, requiring specialized hardware and large amounts of power. Such challenges have long prompted miners to share space and resources. Now, companies that harbor mining equipment are fielding more requests than ever. …

Bcause is one of the firms that have sprung up to cater to aspiring bitcoin miners. In an old beverage warehouse in Virginia Beach, the start up is running thousands of rigs for clients from the U.S. to Asia. … Bcause has contracts with clients to house about 60,000 mining rigs and will serve retail clients by renting out spare machines, a process known as “cloud mining.” It has about 5,000 machines up and running, and plans to outfit another site in eastern Pennsylvania.

The profitability of mining bitcoin hinges on the cost of buying the mining rigs — the Antminer S9 is the most popular — electricity, and, of course, the price of bitcoin. Right now, despite a recent slide, the price is still high by historical standards, and bitcoin mining is said to be “insanely profitable.”

As a hosting service, Bcause says it is insulated from price volatility because it doesn’t invest in the mining equipment or the cryptocurrency itself. However, it does plan to build out a one-stop shop for trading bitcoin, including a clearinghouse, and derivatives exchanges.

I confess: I don’t get it. I don’t understand what bitcoin is good for, other than as a vehicle for maniacal speculation. I don’t understand how bitcoin mining works. Maybe there is some social utility from all this fevered activity, but maybe we’re just bystanders to the 21st tech-economy answer to the 17th-century Dutch tulip bulb mania. Will bitcoin become the Next Big Thing, like the Internet, that will revolutionize commercial transactions and transform our lives? I don’t know. Will it crash and burn? I don’t know.

Peter Diamandis, serial tech entrepreneur and founder of the X Prize Foundation, spoke at the Richmond Forum earlier this month. He made the case that technological change is accelerating, driven by the geometric increase in computational power and the growing capabilities of Artificial Intelligence. A colleague of Ray Kurzweil, the author who coined the phrase, “The Singularity,” Diamandis said that technology is rapidly approaching escape velocity in which change will no longer be in human hands. So, yeah, it won’t be long before the robots take over.

Curse you, bitcoin!

In a world in which all the rules are changing, how do we know what to do? Will our skills and knowledge be worth anything a decade or two? What will happen to our pension funds and personal investments as half the companies in any given portfolio is disrupted and rendered worthless? Will there be any work to do, or will robots do it all for us? Will there be any purpose or meaning to human existence?