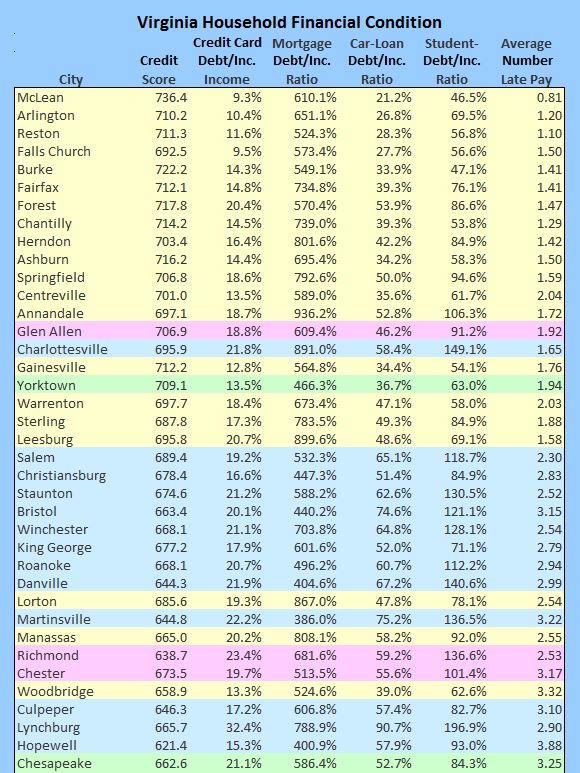

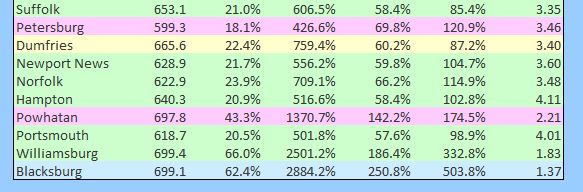

Back in January, Bacon’s Rebellion published a WalletHub ranking of Virginia communities by average credit score. Today, the consumer finance website has dug deeper into the data, compiling a ranking of communities by personal “money management.” The ranking, a composite of indebtedness ratios and related indicators, provides a snapshot of the consumer health of some 2,570 communities around the nation. I have extracted the Virginia communities in the listing.

This list does not differ greatly from the one I published in January, but it contains more data, showing the considerable variation in different types of debt — mortgage, credit card, car and student loans. (What a surprise, Blacksburg, home of Virginia Tech, is loaded up with student loan debt!) Northern Virginia consumers enjoy the least debt as a ratio of income, while Hampton Roads consumers are most deeply mired in debt overall, with Richmond-area consumers close on their heels.

The big surprise is the extent to which consumers outside the Golden Crescent (seen in blue) have refrained from piling up debt. Even down-in-the-mouth mill towns with high unemployment rates, like Danville and Martinsville, maintain a more manageable debt load than communities in Hampton Roads and metro Richmond. Whether that’s due to a rural prudence, institutional reluctance to push credit in these areas, or the prevalence of an older population that has saved more, I don’t know. But the numbers suggest an underlying resilience. As for Hampton Roads, entire region (excluding Yorktown) looks weak — a hangover from sequestration, I suppose, but not one that Northern Virginia appears to be experiencing.

— JAB