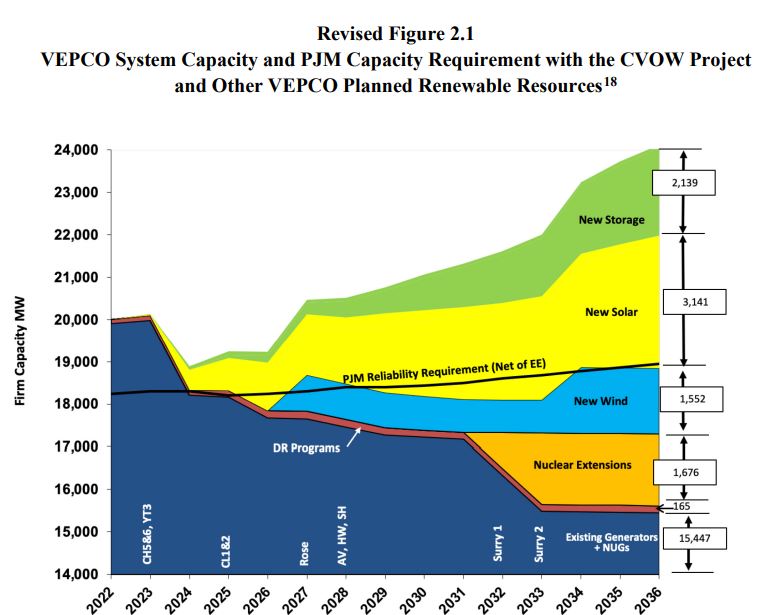

Exhibit submitted by Office of the Attorney General showing the excessive generation Dominion Energy will have compared to its expected demand, funded by ratepayers. The black line in the middle is the projected customer demand. Click for larger view.

by Steve Haner

There is no justification for Dominion’s $10 billion offshore wind project other than that the General Assembly has ordered it, a witness for Virginia’s Attorney General has testified. The utility doesn’t need its electricity, doesn’t need its renewable energy attributes, and is ignoring lower cost alternatives if it does need generation in the future. Further, its claims of economic benefit are based on faulty assumptions.

Virginia’s Attorney General Jason Miyares is the customers’ main representative at the table as the State Corporation Commission reviews this pending application. By law the AG office serves as Consumer Counsel in these matters. Despite all the concerns raised in his expert’s review, Miyares is not recommending that the SCC reject the project.

In fact, as mentioned in an earlier Richmond Times-Dispatch review of the case testimony, no party so far has recommended that the SCC reject it. That was noted by a triumphant Dominion spokesman at the end of the newspaper’s story when it might properly have been the headline.

That is the headline at this stage of the case. The language inserted into the 2020 Virginia Clean Economy Act by Dominion and its environmentalist allies demands approval of the project without regard to proving necessity, reasonableness or prudence. The law orders the SCC to find the project prudent unless it misses a very high cost target or fails to have a plan to start operation by 2028. (Note, it doesn’t have to be in operation then, merely have a plan.)

The portion of the VCEA dealing with solar farms lacks the “shall be deemed prudent” language. In the most recent review of solar projects, both the Attorney General and various environmental groups filing under the umbrella of Appalachian Voices urged the SCC to deny some of the projects as too costly.

The Attorney General’s expert is left recommending that the SCC set a cost cap on the project, enhance project monitoring and somehow shift financial risk onto the company for delays or overruns. An outside expert hired by advocacy group Clean Virginia also recommended a cost cap in his previously reported testimony.

Yet to testify is the SCC’s own staff with its analysis of the project, which is likely to delve more into the financial cost to consumers. That is due April 8. A hearing on the application to build 176 giant wind turbine generators 27 miles off Virginia Beach will start May 16.

There was legislation proposed at the 2022 General Assembly that would have restored the SCC’s ability to say no to this, and Miyares endorsed it through testimony by Senior Assistant Attorney General Meade Browder. Browder heads the consumer section of the office. The bill failed in a Senate committee, not even receiving votes from all the Republicans on the panel.

So, here are many of the things wrong with this application, filed under oath by the utility, as identified by energy witness Scott Norwood of Austin, Texas. Norwood has been a go-to analyst for Browder’s team in several cases. His complaints are listed in the order they appear.

- In calculating its levelized cost of energy (LCOE) for the project, the only grounds on which the SCC could deny this project would be if it proves too high. Dominion assumed a 30-year life of the project. The standard for the industry is to assume 25 years of useful life. “This 30-year service life has not been demonstrated and is not guaranteed,” Norwood wrote. Recalculating based on 25 years boosts the LCOE number, but not over the $125 per megawatt hour ceiling created in the VCEA text.

- State law says the utility must keep and retire the project’s renewable energy credits (RECs) itself to comply with Virginia’s renewable portfolio standard, but Dominion’s accounting reflected selling them to others and generating revenue.

- In projecting its future electricity requirements, seeking to demonstrate the need for this project, Dominion left off the list of its future generation assets all the other forms of renewable energy it plans to build after 2024. Put them back on the projection (as the exhibit above does), and the wind project is not needed through 2035 to produce electricity for Virginians. Dominion will have substantially overbuilt its generation fleet.

- Despite the fact that those other renewable projects actually are in its plan, and largely meet the RPS requirements, Dominion baked into its accounting a $4.9 million “deficiency payment.” This is a provision in VCEA that imposes a cash fine on utilities failing to meet RPS goals. Dominion knew it could meet the goals without the turbines, but still counted the fine as an “avoided cost.” Subtracting that subjective “avoided cost” makes the net project cost appear lower.

- Dominion also threw in the “deficiency payment” in running a cost-benefit analysis on the project, basically accomplished by comparing what it proposes to do with an alternative plan that does not include the 176 turbines and massive required transmission upgrades. Dominion claims the scenario with the wind project is cheaper for consumers.

- Again, the alternate scenario ignored all the other solar and battery projects Dominion has already announced in its officially filed plans. It also programmed its modeling software to force inclusion of the wind project, the coming nuclear relicensing, and avoid selecting additional solar assets.

This difference in renewable resources…improperly imputes “benefits” for the CVOW (Coastal Virginia Offshore Wind) Project in the form of higher capacity sale revenues, lower fuel costs, lower emission costs (carbon taxes) and higher REC deficiency penalty avoidance benefits. (Adjusting for them) increases the cost advantage of the No CVOW case to more than $9.3 billion. (Emphasis added.)

- The cost-benefit analysis did not include any allowances for possible future variations in fuel or energy market prices, or the various carbon taxes included in the projected costs, up or down. Norwood notes Virginia’s new governor is seeking to remove the carbon tax Dominion pays under the Regional Greenhouse Gas Initiative. As with the deficiency payment, avoiding RGGI is accounted for as a financial benefit of the wind project, but not if RGGI goes away.

- The utility is projecting revenue from the sales of its generation capacity into the regional energy market. But Dominion is no longer part of the PJM Interconnect capacity market and has switched to the Fixed Resources Required (FRR) category. What capacity payments? (The same phantom capacity payments were noted by critics in the recent solar applications.)

- Norwood rejects the utility alternative as a least-cost plan, and without seeing a valid least-cost plan, “I am unable to conclude whether the proposed CVOW Project is likely to benefit customers or whether the Project is the best available alternative for supplying the Company’s system capacity, energy and carbon reduction requirements….”

- Finally, Norwood rejects the utility’s assertion that the assumed “social cost of carbon” of $3.2 billion over the study period is actually part of the financial calculation. Building more solar or onshore wind at lower cost could generate the same claimed benefit. Also, it has no impact on what people pay. But the General Assembly ordered the SCC to consider it.

There are other points where he criticized the data or assumptions used by the utility. In an honest review, with the SCC truly required to decide reasonableness and prudence, these issues (and others raised by other witnesses) could doom the project to outright rejection.

Which of course is why the utility wrote a law which left the SCC powerless and persuaded sufficient majorities of both legislative houses to adopt it.