Virginia Trust Fund Solvency. Graphic credit: “Trust Fund Solvency Report 2018.”

There are many measures for gauging a state’s fiscal condition. The most commonly cited is the condition of its General Fund: Is the state balancing its budget? Digging deeper, one can examine the degree to which a state is funding (and falling short of) its pension obligations. And one can track the extent to which a state is neglecting repairs of highways, transit systems, buildings, water-sewer facilities, and other public infrastructure, thus building up future maintenance obligations.

Then there’s the Unemployment Insurance Trust Fund. This is the fund, financed through employer payments, from which states draw to pay benefits to Virginians laid off from their jobs. State funds are designed to build up reserves during good times so they can maintain benefits during bad times when payments spike. If states run dry, they can borrow money from the federal government, which they then are required to repay. States are not directly on the hook for unemployment insurance. But restoring solvency to a fund by hiking employer contributions is the functional equivalent of a business tax increase. Lower business contributions make for a better business climate; higher contributions do the opposite.

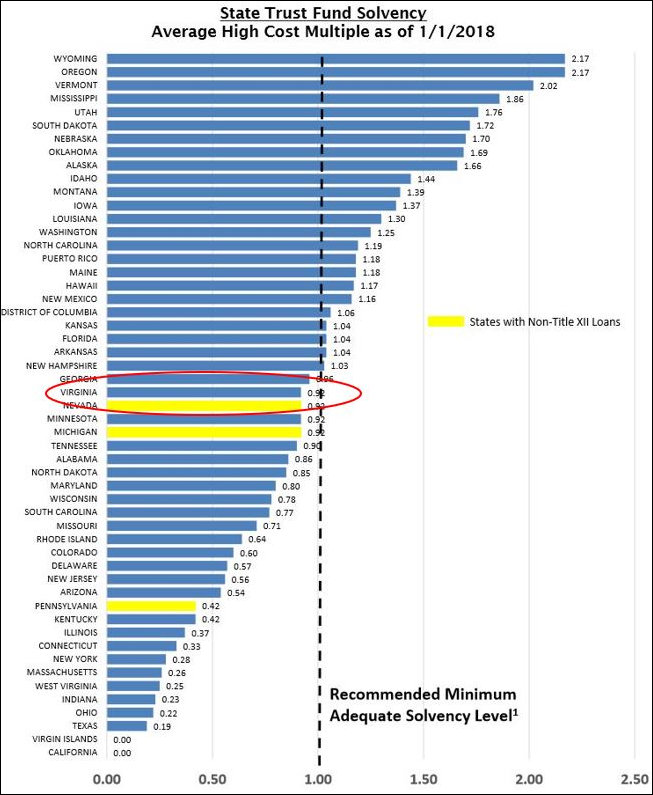

So, it’s worth asking what kind of shape Virginia’s unemployment insurance reserves are in. And the answer is… not very good. Not the worst — we’re not in the same abysmal condition of California, Ohio or Texas, but we fall below the recommended minimum adequate solvency level. We probably could ride out a weak recession, but are ill prepared for a severe one.

The U.S. Department of Labor publishes an annual “State Unemployment Insurance Trust Fund Solvency Report.” Twenty-nine states, including Virginia, are beneath the recommended solvency standards. The Old Dominion’s relative position compared to other states is shown in the chart above. We’re in the middle of the pack. While we’re not far from the recommended level of solvency, we’re still below it — and we certainly haven’t built up large reserves like Wyoming and Oregon.

(For those tracking the 50 states’ progression toward Boomergeddon, note that several states noted for their fiscal profligacy — Illinois, Connecticut, Kentucky and New Jersey — have among the least adequately financed trust funds.)

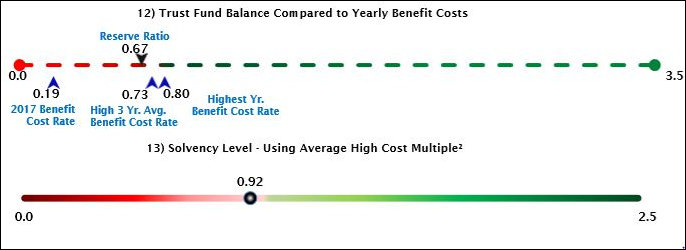

As of Jan. 1, 2018, Virginia has $1,148,000,000 in its unemployment insurance trust fund. That may seem like a lot, but the number is meaningless without comparing it to the number of workers it is meant to cover. The chart atop this post gets to the adequacy of that number. Unfortunately, it is far from self explanatory.

The key numbers are associated with the four blue arrows.

The reserve ratio is derived by taking the trust fund balance and dividing by the state’s total wages paid for the year.

The 2017 benefit cost rate is calculated by expressing the level of uninsurance benefits as a percentage of yearly wages. A smaller number — Virginia’s is 0.19% — is good. It reflects Virginia’s low unemployment rate and low unemployment insurance payments.

But low unemployment is expected during periods of economic expansion. The acid test is how well the trust fund holds up in a recession. So, the Labor Department benchmarks against two measures: (1) the highest benefit cost rate ever, and (2) the average of the highest three highest years over the past 20 years.

The Labor Department then calculates the Average High Cost Multiple, which is the Reserve Ratio divided by the Average Benefit Cost rate. “Values greater than one,” states the report, “are considered the minimum level for adequate state solvency going into a recession.”

Virginia’s value is 0.92, meaning (as I understand it) that its trust fund has 92% of the reserves deemed adequate to make it through a recession without resort to extraordinary measures.