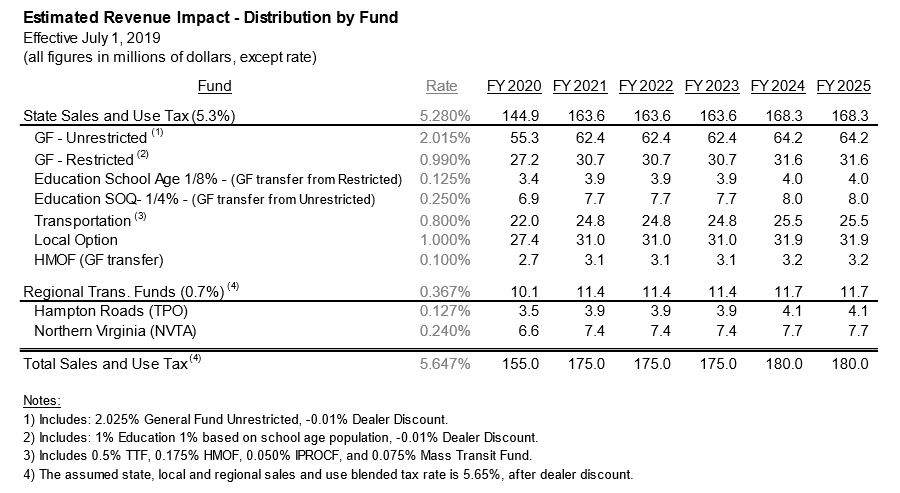

Click for clearer view. The revenue table from the state fiscal impact statement on the internet transaction sales tax bills, about $1 billion over six years.

Both chambers of the General Assembly are on the verge of passing bills expanding the duty to collect state sales tax to internet retailers selling into Virginia, a once controversial idea that is generating far less heat than before but is still hitting resistance.

Senate Bill 1083 and House Bill 1722 still have a few differences that need to be ironed out as the session proceeds, and are proving to be a great example of that famous law of unintended consequences. Uber Eats, of all companies, is worked up about the bill. Orbitz keeps expressing concern.

To ease compliance, among other things, the bill defines and imposes duties on “marketplace facilitators” which are third parties selling products for others but not owning those products. Amazon and eBay are marketplace facilitators, and the idea is with their sophisticated software, it will be far easier for them to calculate, collect and remit the taxes for all the various sellers using their services into all the different states and cities.

To ease compliance, among other things, the bill defines and imposes duties on “marketplace facilitators” which are third parties selling products for others but not owning those products. Amazon and eBay are marketplace facilitators, and the idea is with their sophisticated software, it will be far easier for them to calculate, collect and remit the taxes for all the various sellers using their services into all the different states and cities.

As first drafted, the bill also seemed to make Uber Eats, delivering food from neighborhood restaurants, into a marketplace facilitator. Does that mean it collects and remits the tax, instead of the restaurant? Is there a danger both would be imposing the tax? Are there other companies being sucked into this issue unexpectedly, such as travel websites? What about a marketplace facilitator selling Virginia goods to a Virginia buyer? Some issues and lobbyist billable hours may be punted to a post-session regulatory process.

Another issue which has hung up quick passage is opposition from eBay, which is complaining it won’t be ready to comply by July 1, 2019. It initially asked for several years to comply, which was quickly rejected, but it continues to push for delay. The brick and mortar retailers, who finally see at least one advantage of their on-line competitors disappearing, are pushing back hard for quick implementation. They don’t want another Christmas season without everybody being taxed.

This all flows from a 2018 Supreme Court decision in a case involving the retailer Wayfair, Inc. and South Dakota. The court allowed states to impose their tax rules on retailers with no physical presence (and thus no property for the Tax Man to seize) inside the state.

The court strongly indicated, however, small transactions should be left alone, and Virginia’s proposed law sets the threshold at $100,000 in annual sales or 200 transactions in one year. Another request from eBay, a $250,000 threshold, is also not in the bills as they stand.

What is not proving a hindrance, surprisingly, is how a major promise made to sell the 2013 transportation tax package is falling by the wayfair, oops, wayside. Remember how we were told the higher gas taxes would be rolled back, at least in part, if Congress ever authorized internet sales tax collection? And all the proceeds of any internet transactions tax would then go to transportation?

That goes away. This only a sample of the five opaque paragraphs it takes to do that:

- That the fourth enactment of Chapter 766 of the Acts of Assembly of 2013 is amended and reenacted as follows:

- That Article 22 (§§ 58.1-540 through 58.1-549) of Chapter 3 of Title 58.1 of the Code of Virginia, §§ 58.1-609.13, 58.1-2289, as it may become effective, 58.1-2290, and 58.1-2701, as it may become effective, of the Code of Virginia and the second enactment of Chapter 822 of the Acts of Assembly of 2009, as amended by Chapter 535 of the Acts of Assembly of 2012, are repealed.

Along with less heat, the bills will also generate less money than once expected, which is another reason few want to rely on it for transportation anymore. So many out-of-state companies and internet retailers have already started compliance with Virginia’s tax law, including Amazon, that only about $155 million a year in new revenue is expected in fiscal year 2020 and $180 million by 2024. It will be disbursed on the same complicated formula used for the all sales tax collections – with only about a third not designated to some purpose (mostly education or transportation).

As has been explained and ignored often, this is not a new tax. The sales and use tax always applied to purchases from online sources or catalogs, but the state had no way to force the out-of-state retailer to collect and remit it. Instead, you the purchaser were obligated to pay the tax, usually by fessing up and admitting to the transactions on your Form 760. Few people met their obligation. Previous efforts to make them or to force out-of-state sellers to comply met fierce resistance, which has largely disappeared.

Your legal obligation to report and pay for untaxed transactions remains, however. Continue to keep those receipts for your annual state return! Be just as diligent as you were before.