by Dick Hall-Sizemore

by Dick Hall-Sizemore

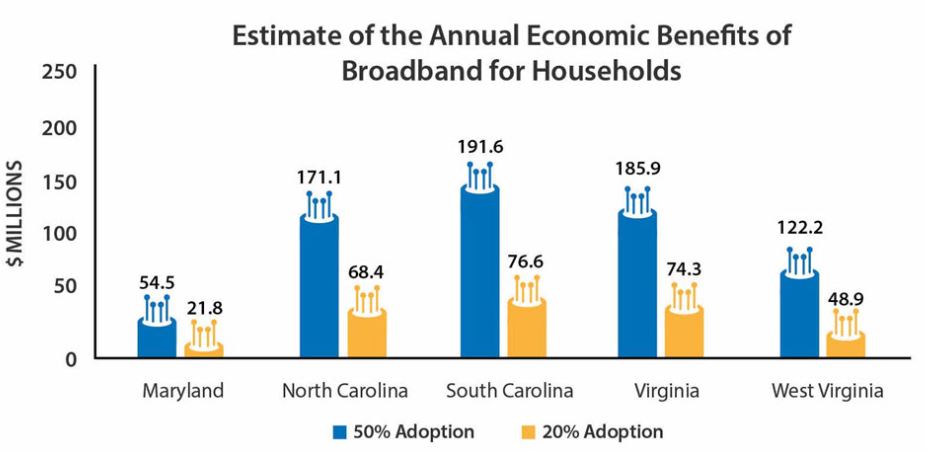

One of the issues underlined by the pandemic was the need for all areas of the state to have access to broadband internet. Without access to broadband, kids (and adults) in rural areas cannot take advantage of courses offered online. To the extent that more people will be working remotely, rural areas need access to broadband in order for those people to move there. Broadband accessibility is necessary for almost all businesses and industries and rural areas will need to have such accessibility if they hope to convince private companies to bring new jobs to their areas.

Thanks to federal funding, the Commonwealth is well on its way to achieving universal availability. The source of most of that funding is the American Rescue Plan (ARP), enacted in early 2021 as part of the Biden administration’s efforts to offset the economic effects of the COVID pandemic. In July of last year, the Northam administration and the General Assembly announced an agreement to allocate $700 million of the state’s ARP funding to broadband expansion. Several months later, that amount grew by $220 million as a result of an allocation from another section of the ARP. Finally, it is expected that Virginia will get $65 million for broadband expansion from the federal infrastructure bill passed last fall. Continue reading

by Dick Hall-Sizemore

by Dick Hall-Sizemore

By Dick Hall-Sizemore

By Dick Hall-Sizemore