by Arthur Purves

Local government compensation is better than private sector.

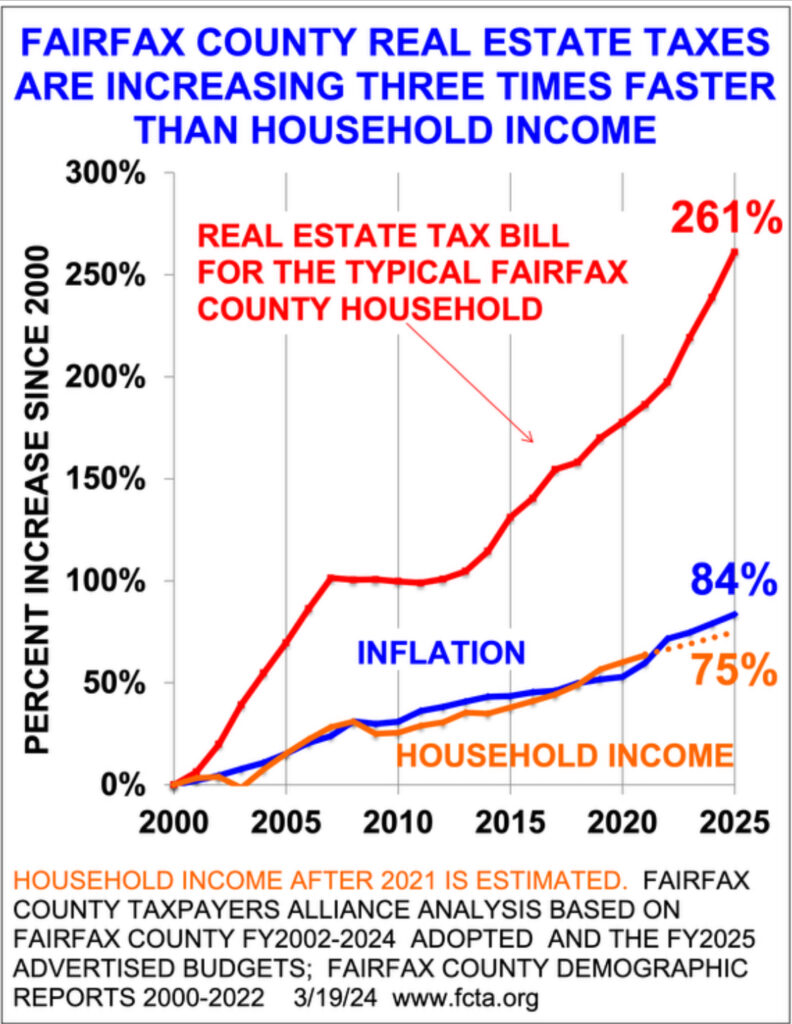

On April 30 the Fairfax County Board of Supervisors will vote on next year’s (FY2025) tax increase. The supervisors have advertised a 7% increase in real estate and car taxes to help pay for $360 million in raises for 38,000 school and county employees.

School raises are 6% and county raises range from 4% to 10%. By comparison, the county says that inflation is 2.5%. For next year, the Fairfax County Board of Supervisors, under Chairman Jeff McKay, is proposing a 7.1% or $618 tax increase for the typical residential household. This is the second largest tax hike in ten years, exceeded only by last year’s 8.9% increase.

Next year’s tax hike is made up of an average 6.5% or $531 increase in the combined real estate and stormwater tax, both of which are based on household assessments, plus a 16% or $87 increase in the car tax.

This continues the supervisors’ quarter-of-a century habit of increasing residential taxes three times faster than household income. They are advertising a 4-cent increase in the real estate tax rate, from $1.13 to $1.17 (includes the 3-cent stormwater tax), on top of a nearly 3% average increase in residential assessments.

Unless they hear from homeowners, the supervisors will probably adopt a rate of $1.16 when they finalize the budget on April 30, in hopes that homeowners will be relieved that the rate increased 3 cents instead of 4 cents. Continue reading

by Jon Baliles

by Jon Baliles

by Derrick A. Max

by Derrick A. Max